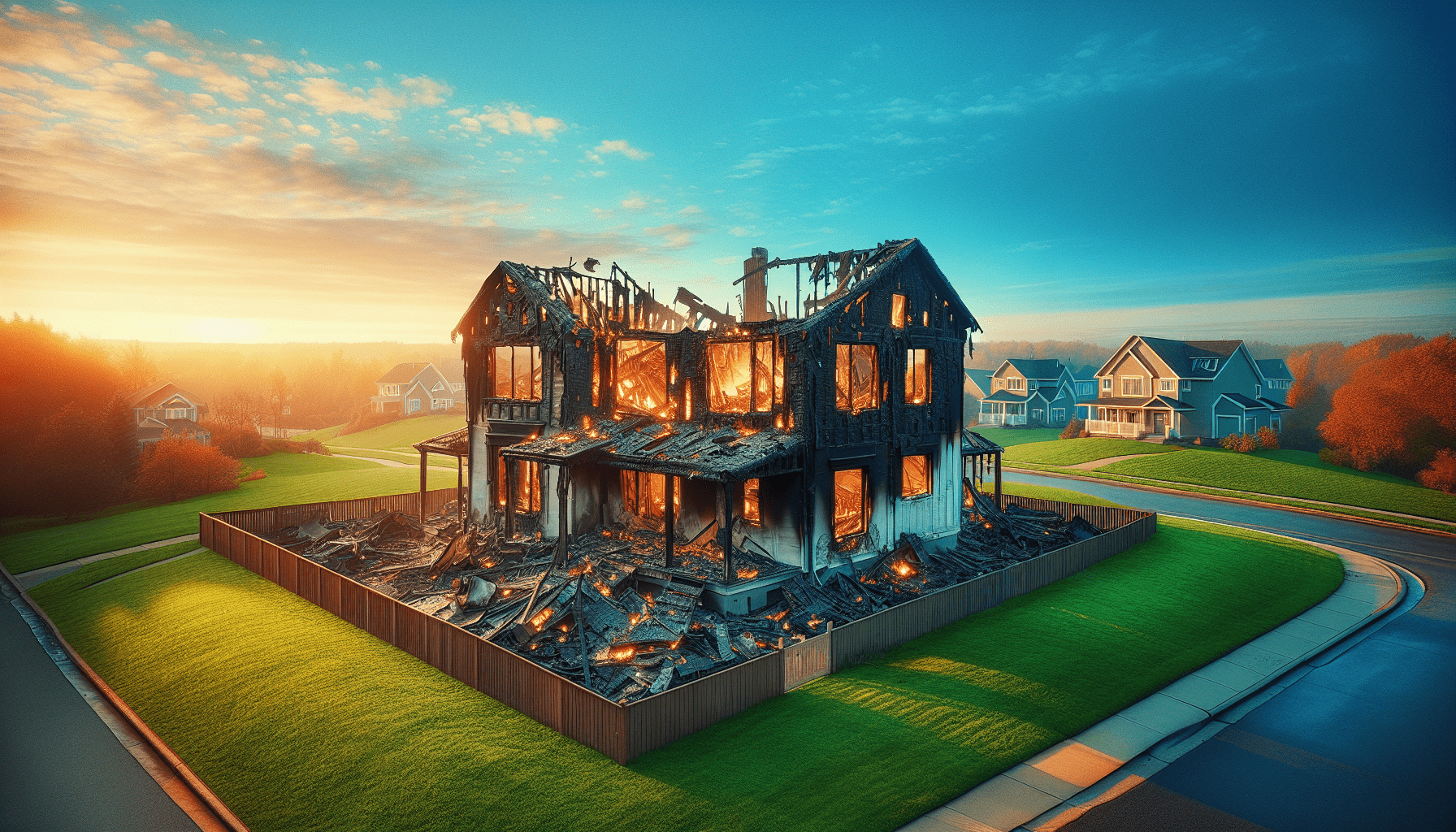

Have you ever wondered what to do after a fire damages your home? It’s a distressing experience that can leave you feeling overwhelmed and unsure. Understanding how a fire insurance claim works might ease some of that confusion. You are not alone in this situation, and the steps you take can make a significant difference in how smoothly the process unfolds.

Understanding Fire Insurance

Before you file a claim, it’s essential to know what fire insurance is and how it works. Fire insurance is a type of policy that protects your property from damages caused specifically by fire. This coverage can extend to your home and personal belongings, depending on the policy.

Understanding your policy is crucial. Review the specific protections offered and any exclusions. Fire insurance is not a catch-all; knowing the limits of your coverage helps you set appropriate expectations.

Common Fire Insurance Coverage Types

Here’s a breakdown of common coverage types you might find in a fire insurance policy:

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Covers repairs to your home structure. |

| Personal Property | Covers damaged or destroyed belongings. |

| Additional Living Expenses | Helps cover costs if you need to live elsewhere during repairs. |

| Liability Coverage | Protects you against claims from others affected by the fire. |

If you have any questions about your specific policy, it may be beneficial to reach out to your insurance agent for clarity. They are there to help you and can provide specific answers tailored to your situation.

The Steps After a Fire

Your immediate priority after a fire is ensuring safety. Once the flames are out, your focus shifts to assessing damage and starting the claims process. This can feel like a monumental task, but breaking it down into manageable steps can help.

Ensure Everyone is Safe

Before anything else, check on the safety of everyone involved. If you’re in a safe location, only then should you look at the damage to your property. It’s vital to keep loved ones at the forefront of your thoughts during this time.

Document the Damage

Taking thorough documentation of the damage will benefit your claim. Use your phone or another device to take pictures of everything affected by the fire. Include images of:

- Structural damage

- Damaged personal belongings

- Areas that experienced smoke damage

Having this visual record provides clear evidence when you submit your claim.

Contact Your Insurance Company

Reach out to your insurance provider. Notify them about the incident and ask for guidance on filing a claim. Each company may have different procedures, so it’s wise to follow their instructions carefully.

Filing the Claim

After informing your insurance company, the next step is filing the claim formally. This step may seem daunting, but breaking it down can help simplify the process.

Gather Documentation

Collect all necessary documents, such as your insurance policy, photographs of the damage, a list of damaged items, and any repair estimates. Having everything organized makes the process easier.

Complete the Claim Form

Your insurance company will provide you with a claim form. Ensure that you fill it out completely and accurately. Pay careful attention to the details you include. Any errors or omissions can lead to delays or disputes when your claim is being processed.

Submit Your Claim

After your form is complete and documents are organized, submit the claim to your insurance company. Many companies now allow electronic submissions, which can make this step quicker and more efficient. If you prefer, you can submit via mail, too.

The Role of a Public Adjuster

In times of distress, the last thing you want is to feel overwhelmed by the claims process. This is where a public adjuster can step in to help.

What is a Public Adjuster?

A public adjuster is an insurance professional who advocates on your behalf. They work to ensure you receive the full compensation entitled under your insurance policy. While it may not seem necessary, hiring a public adjuster can take a significant burden off your shoulders.

Why Consider a Public Adjuster?

-

Expert Guidance: A public adjuster understands the ins and outs of insurance claims. They can help you navigate between policy language and the insurance company’s requirements.

-

Fair Compensation: Sometimes, insurance companies might undervalue a claim. A public adjuster knows how to accurately assess and negotiate for the compensation you deserve.

-

Time and Stress Reduction: Engaging a public adjuster means you don’t have to manage each step alone. They handle communications and negotiations, allowing you to focus on recovery.

Choosing a Public Adjuster

If you decide to hire a public adjuster, it’s essential to do your research. Look for an adjuster who has experience with fire claims specifically. Consider checking reviews or asking for referrals from friends or family.

A reputable option in Florida is Otero Property Adjusting & Appraisals. They offer free, no-obligation inspections and focus on getting you the compensation you deserve. You can reach them at (850) 285-0405 or visit their website at oteroadjusting.com.

The Claim Review Process

After you submit your claim, the insurance company will begin the review process. This period can take time, so it’s critical to remain patient.

What to Expect

During this phase, an adjuster from your insurance company may reach out to discuss your claim. They will likely ask to inspect the damage you reported. Be prepared for them to take additional documentation, as their goal is to assess all relevant details.

Communication is Key

Keep the lines of communication open with your insurance company. If you don’t hear back in a reasonable time, follow up to check on the status. Maintaining this dialogue can ensure everything stays on track.

Possible Outcomes

-

Claim Approval: If everything checks out, you will receive a claim approval with compensation details.

-

Request for More Information: The insurance company might ask for additional documentation or clarifications. Respond promptly to avoid unnecessary delays.

-

Claim Denial: In some unfortunate situations, claims can be denied. If this happens, it’s essential to understand why. You may have the right to appeal the decision, and a public adjuster can help clarify your options.

Receiving Your Payment

Once your claim is approved, you will move on to the payment phase. This process can vary depending on your policy and the extent of your damages.

Understand Your Payment Options

Typically, you will receive an upfront payment to cover immediate repair costs. Additional payments may follow as more damages become apparent or once repairs are completed. Ensure that you use these funds carefully and only for the intended purposes.

Consider Your Repair Options

With your payment in hand, you can start the repair process. You can choose your contractors or follow your insurance company’s recommendations. Remember that you have the final say in who performs the repair work on your property.

Preparing for Future Incidents

Once you recover from the fire and finish the claims process, start thinking about the future. Being proactive can help you prepare for potential incidents down the line.

Regular Policy Review

Make it a habit to review your insurance policy regularly. Life circumstances can change; ensure your coverage reflects your current needs. You might need to adjust your policy to include new valuables or upgrades in your home.

Fire Safety Measures

Investing in fire safety measures is a wise step to protect yourself and your home. Consider installing smoke detectors, fire extinguishers, and creating an escape plan. Regularly check and maintain your fire safety equipment to ensure it’s functioning correctly.

Continuous Education

Take the time to educate yourself and your family about fire safety and prevention. Knowledge about potential fire hazards and safety practices can empower you to minimize future risks.

Final Thoughts

Experiencing a fire at your home is undoubtedly a distressing situation. The unpredictability can shake your sense of security. Understanding how a fire insurance claim works offers a degree of clarity amidst the chaos.

You can navigate the claims process with patience, organization, and perhaps a public adjuster at your side. Make sure to take care of both your property and your emotional well-being throughout this journey. Remember, you have support available, and you do not have to face this alone.

If you find yourself in need, consider reaching out to Otero Property Adjusting & Appraisals at 3105 W Michigan Ave, Pensacola, FL 32526, or by calling (850) 285-0405. Their experienced team is ready to help you secure the compensation you deserve for your fire-related damages.

You are not at the mercy of your situation. Equip yourself with knowledge, support, and a plan, and you can emerge from this experience stronger.